Allied Nevada was formed in 2006 and is a spin-off of Vista Gold as well as a combination of literally dozens and dozens of exploration sites in Nevada. So if you think Nevada has good mining prospects, you might want to own some Allied because they pretty much have the whole state covered it seems.

Hycroft

The Hycroft mine is an open pit, heap leach gold and silver operation. It's Allied Nevada's flagship mine and the only mine they currently have in production. It was placed on care and maintenance in late 1998 due to low metal prices. While in production (1987-1998), Hycroft produced over one million ounces of gold using a surface heap leaching process.

In September of 2007, the newly formed Allied Nevada reactivated the Hycroft mine and commercial production was achieved by the end of 2009. Based on this operating plan, gold production for 2010 is expected to be approximately 100,000 oz at a cash cost of $400-$450 per oz.

However, there is a lot more to the story here. Currently the oxide ore at Hycroft is being mined, but Allied is also doing a pre-feasibility on the sulfide ore as well.

Oxide

A $212 million expansion project is now underway at the Hycroft mine which is going to increase the output significantly. The mining rate is expected to increase from 25 million tons of material per year to 80 million tons of material. 80 million tons per year will be achieved by 2013, and includes 37 million tons of ore and 43 million tons of waste with approximately 30% of the ore being crushed.

The company expects production to increase from approximately 100,000 ounces in 2010 to over 250,000 ounces of gold in 2012 and peaking at over 300,000 ounces in each of 2013 and 2014. Average annual silver production is expected to be in excess of 1 million ounces.

Now with the accelerated mining plan, the current oxide reserves are only sufficient to support this mining rate until 2015. However, Allied Nevada believes that ongoing exploration will continue to convert oxide resources, which will extend the mine life beyond 2015.

A new 3.5 million square foot leach pad expansion is also on track for completion in the third quarter of 2010, with one third of the expansion area lined and being prepared to accept new ore. A recent expansion of the Merrill‐Crowe plant has increased the capacity by approximately 10%. And a new crushing circuit was added in which 30% of the ore mined will find its way through.

Allied Nevada is also studying the possibility of converting from the current heap leach operation to a grinding and milling operation. Recoveries are only 60% for gold and 18% for silver with the heap leach. If the economics look good, a mill will definitely improve recovery rates, especially for silver.

Sulfide

The Hycroft mine also has over 3 million ounces of gold in the sulfide measured and indicated resource category. Allied Nevada is in the initial stages of preparing a feasibility study to determine the economic viability of mining this sulphide mineralization. It is currently expected that this study will be completed by mid-2011. Preliminary metallurgical testing completed in 2009 indicated that gold and silver recoveries are expected to be +80%.

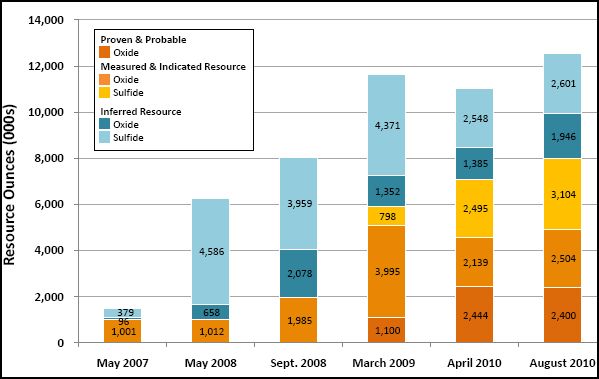

Gold Resources:

Earlier in the year Allied Nevada released a positive scoping study for the sulfide expansion. It was estimating a 30,000 tpd mill and flotation plant, which would produce 275,000 oz of gold and 6.5 million oz of silver per year for 12 years. The total cost was going to be about $260 million. Then the company blew that out of the water with an updated scoping study that was completed in September 2010. The new study predicts a 100,000 tpd mill and a 74,000 tpd heap leach operation. Annual production would be an astounding 610,000 oz of gold and 27 million oz of silver per year(using silver as a by product credit).

Updated scoping study completed September 2010:

* Estimated capital cost of $1.1 billion

* Average annual production of approx. 610,000 oz Au, 27.0 mm oz Ag for 13 years (1.1 million oz AuEq)

* Average annual cost of sales of approx. $350/oz of gold sold (with silver byproduct credit)

* Assumes 100,000 tpdmill and 74,000 tpdheap leach scenario

* Strip ratio of 1.56:1

* 174,000 tpdoperation (100,000 tpdmill and 74,000 tpdheap leach)

* Ongoing exploration and metallurgical testing should further upgrade inferred resources, extending mine life

* A feasibility study is expected to be completed in mid-2011

Silver

I want to just talk a little about the silver aspect of Allied Nevada. To date, only 50% of the resource from the Hycroft mine has silver assay data. In other words, there is a significant under-reporting of the actual silver that is contained there. I don't want to speculate but they already have 500 million oz of silver resources.

Silver Resources:

Exploration

You want lots of exploration potential, well you've got it with Allied Nevada. In addition to Hycroft, the company owns 100% of the Wildcat, Mountain View, Hasbrouck and Three Hills projects and has a joint venture interest in the Maverick Springs project. The total measured and indicated resource contained on these projects is over 3 million ounces of gold.

Allied Nevada also has interests in over 100 exploration properties located in the major gold producing districts in the state of Nevada.

Management

The management of Allied Nevada is basically the management of Kinross Gold circa 2005-2006. Bob Buchan is the Chairman of Allied Nevada, he was founder and President and CEO of Kinross Gold Corporation until 2005. Scott Caldwell is the President and CEO of the company, he was Chief Operating Officer of Kinross Gold Corporation until August 2006.

It seems like the entire upper management and a host of directors were once with Kinross.

Kinross went from 25,000 oz of production to over a 1.5 million when Bob Buchan was the CEO. And I guess he wanted his old team to help him do the same with Allied Nevada.

Let me be clear, these guys aren't going to settle for 100,000 oz of gold production per year. They are going to try and create a 1 million+ oz gold company.

Financials and Production

Q2 2010 Highlights:

* Hycroft operations achieved record production in the second quarter of 2010 of 31,400 ounces of gold and 62,000 ounces of silver.

* Record net income of $20.8 million ($0.26 per share) in the second quarter of 2010, $24.4 million ($0.32 per share) year-to-date, compared with a net loss of $6.9 million ($0.12 per share) and $14.5 million ($0.25 per share) for the same periods in 2009.

* Revenue from gold sales of 29,560 ounces was $35.9 million in the second quarter of 2010 compared with 3,944 ounces of gold sold in the second quarter of 2009 for revenue of $3.7 million. In the first half of 2010, revenue from gold sales of 49,999 ounces was $58.5 million compared with revenue of $6.9 million from the sale of 7,343 ounces of gold in the first half of 2009.

Cash and cash equivalents at June 30, 2010 were $346.0 million, the company has no debt.

88 million shares outstanding

With the accelerated mining plan, production is going to ramp up to well over 250,000 per year. This doesn't take into account any production from the sulfide ore.

You want lots of exploration potential, well you've got it with Allied Nevada. In addition to Hycroft, the company owns 100% of the Wildcat, Mountain View, Hasbrouck and Three Hills projects and has a joint venture interest in the Maverick Springs project. The total measured and indicated resource contained on these projects is over 3 million ounces of gold.

Allied Nevada also has interests in over 100 exploration properties located in the major gold producing districts in the state of Nevada.

Management

The management of Allied Nevada is basically the management of Kinross Gold circa 2005-2006. Bob Buchan is the Chairman of Allied Nevada, he was founder and President and CEO of Kinross Gold Corporation until 2005. Scott Caldwell is the President and CEO of the company, he was Chief Operating Officer of Kinross Gold Corporation until August 2006.

It seems like the entire upper management and a host of directors were once with Kinross.

Kinross went from 25,000 oz of production to over a 1.5 million when Bob Buchan was the CEO. And I guess he wanted his old team to help him do the same with Allied Nevada.

Let me be clear, these guys aren't going to settle for 100,000 oz of gold production per year. They are going to try and create a 1 million+ oz gold company.

Financials and Production

Q2 2010 Highlights:

* Hycroft operations achieved record production in the second quarter of 2010 of 31,400 ounces of gold and 62,000 ounces of silver.

* Record net income of $20.8 million ($0.26 per share) in the second quarter of 2010, $24.4 million ($0.32 per share) year-to-date, compared with a net loss of $6.9 million ($0.12 per share) and $14.5 million ($0.25 per share) for the same periods in 2009.

* Revenue from gold sales of 29,560 ounces was $35.9 million in the second quarter of 2010 compared with 3,944 ounces of gold sold in the second quarter of 2009 for revenue of $3.7 million. In the first half of 2010, revenue from gold sales of 49,999 ounces was $58.5 million compared with revenue of $6.9 million from the sale of 7,343 ounces of gold in the first half of 2009.

Cash and cash equivalents at June 30, 2010 were $346.0 million, the company has no debt.

88 million shares outstanding

With the accelerated mining plan, production is going to ramp up to well over 250,000 per year. This doesn't take into account any production from the sulfide ore.

0 comments:

إرسال تعليق